Shifting Gears in the U.S. Manufacturing Landscape

The U.S. manufacturing environment in 2025 is full of problems and unpredictable twists and turns. Recent data have revealed a striking divergence between core durable goods and transportation orders. As core durable goods rose modestly, transportation orders plummeted dramatically, largely because of aggressive tariff policies and wrenching supply chain snags. For investors trying to find their way in this environment, it’s time to take a closer look at the broader picture: many traditional industrial sectors are struggling, while tech services are on the rise, riding the wave of digital transformation and AI innovation.

These developments have stirred conversation among investors, who are increasingly debating whether to pivot their capital from cyclical chemical industries—which are laden with issues and subject to unpredictable market swings—to tech services, a sector buoyed by cloud computing, AI, and robust digital adoption. In this opinion editorial, we will dig into the key details of the current industrial scene, articulate the differences between these two sectors, and offer actionable advice on how to make your way through these tricky parts amid industrial demand weakness and a shifting regulatory landscape.

U.S. Manufacturing Trends 2025: Transportation vs. Core Durable Goods

In the heart of the 2025 U.S. manufacturing landscape, a tale of two sectors unfolds. The transportation equipment segment recorded a staggering 22.4% decline in orders. This fall has been driven by not only aggressive tariff policies but also tangled issues in the supply chain. When transportation orders are contrasted with the core durable goods, which managed a slight uptick of 0.2% monthly and a year-over-year growth of 2.2%, the picture becomes both confusing and illuminating.

This split between segments demonstrates that even within the manufacturing umbrella, there are clear winners and losers. Machines, industrial equipment, and defense-related products—grouped under the core durable goods—have displayed relative resilience, while transportation equipment has been spotted using the brakes because of tariff-related shocks and supply hiccups. Many investors find this distinction to be a perfect example of the fine points of market segmentation impacting investment strategies.

Understanding the Industrial Divide

To better grasp the situation, consider these key observations:

- Core Durable Goods Stability: The machinery and equipment sectors, largely insulated from the direct impacts of harsh tariff policies, continue to reflect steady growth even when other areas struggle.

- Transportation Turmoil: Transportation orders have suffered because of both aggressive trade policies and supply chain blockages that have introduced a host of intimidating and complicated pieces into the market.

Table 1, presented below, provides an overview of these trends:

| Category | Monthly Change | Key Factors |

|---|---|---|

| Core Durable Goods (Excluding Transportation) | +0.2% | Stable industrial demand, resilient manufacturing segments |

| Transportation Equipment | -22.4% | Aggressive tariffs, supply chain snags |

This stark contrast not only throws into relief the sectors that are more robust versus those that are more vulnerable, but it also underscores why investors might consider shifting their focus in the short to medium term.

Weighing the Chemical Industry’s Tricky Parts

Cyclical chemicals have long been a cornerstone of industrial production, contributing to various downstream sectors such as semiconductors and clean energy. However, their growth remains modest, hovering around 3.5% globally in 2025. The chemical industry, with its widespread applications, is not immune to the tangled issues of supply chain disruptions and regulatory hurdles that affect many manufacturing sectors.

Looking at U.S. industrial production, the chemical industry encountered marginal growth in 2023—only about 0.2%—and essentially flat performance in 2024. This lackluster growth signals that upon closer inspection, the industry is full of problematic parts that can make it a less attractive bet for investors looking for high-growth opportunities.

Challenges in the Chemical Sector

The chemical industry faces several problematic twists and turns:

- Regulatory Risks: With more stringent environmental regulations coming into play, many chemical companies are forced to pivot their investment strategies while grappling with red tape.

- Supply Chain Volatility: Global supply chains, particularly in regions like Europe and Asia, are loaded with issues that have a knock-on effect on local production and prices.

- Cost Efficiency Pressures: Operating efficiency remains a challenge as companies try to balance cost-cutting measures with the need for modernized production techniques.

When you sift through these details, it becomes clear that the chemical industry, while still important, is subject to a host of intimidating and nerve-racking factors. Its cyclical nature makes its earnings more unpredictable in periods of both economic downturns and bursts of growth.

Comparative Analysis: Chemical Industry vs. Tech Services

Below is a table summarizing the most critical differences between cyclical chemicals and tech services:

| Aspect | Cyclical Chemicals | Tech Services |

|---|---|---|

| Growth Expectations (2025) | Modest, around 3.5% globally | High-growth, with projected earnings increase around 16.9% |

| Supply Chain Stability | Subject to complicated disruptions and tariff impacts | More insulated due to reliance on digital and intangible assets |

| Regulatory Environment | Riddled with issues due to environmental and safety rules | Generally free from many of the physical product regulations |

| Investment Appeal | Limited by economic cycles and cost pressures | Enhanced by digital transformation, scalability, and innovation |

This clear-cut comparison shows why many experts are now recommending that investors carefully consider reducing their exposure to cyclical chemicals and instead steer through markets by increasing investments in tech services.

Tech Services: Riding the Wave of Digital Disruption

For the past few years, tech services have surged to the forefront of investor interest, driven by sweeping digital transformation across all sectors. As companies worldwide increasingly adopt cloud computing and AI solutions, the tech services sector has emerged as a haven for growth-oriented capital. With projected earnings growth of nearly 17% in 2025 and major players like Microsoft and Amazon setting the pace, this sector represents an appealing option for those seeking to secure long-term competitive advantages.

This digital revolution is highlighted by the explosive investments and strategic shifts that tech service companies have undertaken. For instance, Microsoft’s fiscal third quarter saw a dramatic 53% surge in its AI infrastructure spend, an impressive figure that underscores both the pace of innovation and the sector’s ability to generate scalable revenue streams. Moreover, as the U.S. dollar experiences periods of weakness, global tech companies—even those headquartered outside of the United States—are positioned to gain from enhanced earnings and cost efficiencies.

Key Drivers of Growth in Tech Services

There are several critical factors fueling growth in tech services:

- Digital Transformation: Industries across the board are rapidly integrating digital solutions to improve operational efficiency and customer engagement.

- Cloud Computing: With adoption rates increasing rapidly, the cloud has become the backbone of modern business operations.

- AI Adoption: The move towards artificial intelligence is transforming traditional business models, resulting in improved productivity and efficiency.

- Intangible Assets: Unlike physical goods, tech companies rely heavily on intellectual property and innovative solutions that are less affected by physical supply chain issues.

These factors mean that tech services not only have a broader runway for growth—they also benefit from a more insulated position when compared to sectors heavily reliant on tangible products. This gives investors a super important edge when assessing risk and potential returns in a volatile economic landscape.

How Cloud Computing and AI Are Rewriting the Rulebook

As we poke around into the digital revolution, two trends stand out: cloud computing and AI. Companies that have managed to integrate these technologies into their core operations often find themselves enjoying dramatic jumps in efficiency and revenue. For example, cloud platforms like Microsoft Azure and Amazon Web Services have become essential tools for businesses looking to modernize and scale their operations.

These digital services enable firms to reduce overhead costs and improve operational flexibility, which in turn contributes significantly to the overall earnings potential. The intangible nature of digital technology also means that these companies face fewer physical challenges and can more easily adapt to market disruptions compared to industrial manufacturers dealing with heavy tariffs and supply bottlenecks.

Tariff Impacts and Policy Concerns: Working Through the Red Tape

The overall economic landscape is not without its challenges, and policy-related headwinds continue to dog the industrial sectors. The Trump-era tariff regime has proved to be a wrench in the supply chain, reducing semiconductor imports significantly and creating expensive production bottlenecks across multiple segments. Investors should be on alert as new tariffs on Japan, South Korea, Canada, and the EU loom on the horizon.

These policy moves introduce a series of intimidating and nerve-racking bits of uncertainty. For instance, while domestic production in some sectors has slightly increased, the overall impacts of these tariffs have been widespread, ultimately leading to a more complicated market environment where traditional manufacturing and chemicals are vulnerable. In contrast, tech services—owing to their reliance on intangible assets and digital infrastructure—manage to sidestep many of these physical limitations.

Assessing the Tariff-Driven Supply Chain Snags

There are several factors to consider when figuring a path through these policy impacts:

- Impact on Semiconductor Imports: Tariff policies have reportedly reduced semiconductor imports by up to 70%, forcing domestic producers into an uphill battle.

- Disruptions in Transportation Equipment: Aggressive tariffs have led to a 22.4% drop in transportation orders, creating significant challenges for companies dependent on these segments.

- Inconsistent Domestic Production: While some pieces of the economy have seen a slight uptick in domestic output, many sectors remain mired in supply chain tangles and confusing bits of regulatory uncertainty.

By sorting out these policy issues and understanding the direct consequences for industrial production, investors can better gauge which sectors are poised for growth and which might continue to suffer under the weight of new trade restrictions.

Table: Policy Impacts Across Sectors

| Sector | Policy Impact | Market Response |

|---|---|---|

| Transportation Equipment | Aggressive tariffs and supply disturbances | Significant decline in new orders |

| Cyclical Chemicals | Regulatory pressures and environmental rules | Modest global growth challenged by volatile factors |

| Tech Services | Relatively insulated from physical tariffs | Strong earnings growth driven by digital transformation |

This table makes it clear that while tariff impacts are a heavy burden for traditional manufacturing and chemicals, tech services stand out as a more resilient alternative in a period overloaded with issues and regulatory twists.

Investment Strategies: Sector Rotation and Building a Diversified Portfolio

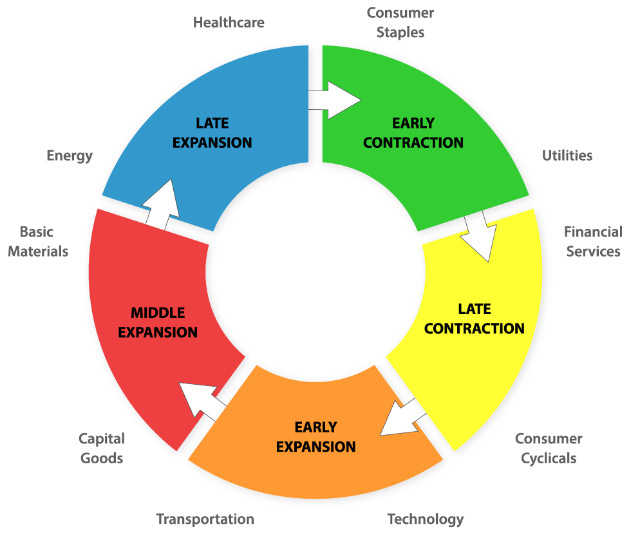

As the industrial landscape continues to evolve, many experts argue that investors should consider a deliberate shift—rotating from cyclical chemicals to tech services. This strategy leverages the high-growth nature of digital transformation to hedge against the unpredictable performance of traditional manufacturing segments. By overweighting tech services, particularly in areas like cloud computing and AI, investors can build a portfolio that’s more resilient in the face of confusing bits and unexpected policy surprises.

Here are some actionable steps that can help investors make a smoother transition:

- Overweight Tech Services Exposure: Consider dedicated tech ETFs (such as XLK) as well as top-performing tech stocks like Microsoft, Amazon, or Nvidia for concentrated exposure to the digital revolution.

- Underweight Cyclical Chemicals: Reduce reliance on pure-play chemical producers that are vulnerable to commodity price swings and regulatory shifts. Instead, consider diversified holdings that spread risk across multiple sectors.

- Monitor Policy Developments: Keep a close watch on upcoming tariff announcements and trade policies. With potential changes on the horizon, staying informed can help you quickly adapt your investment strategy.

It’s also beneficial to maintain a diversified approach that balances growth opportunities with risk management. While tech services represent a super important element of modern portfolios, having a mix of assets can ensure that overall risk is spread out even when individual sectors are hit by intimidating and nerve-racking issues.

Risk Management Tactics for a Turbulent Economy

In an environment as full of problems as today’s economy, risk management becomes a key pillar of any successful investment strategy. Try incorporating the following tactics:

- Regular Portfolio Rebalancing: This helps in adjusting your investment mix based on shifting market conditions. Reassessing your allocations periodically will ensure that you avoid being overexposed to any one industry, especially sectors subject to sudden supply chain snags.

- Diversification Across Asset Classes: Beyond equities, consider adding bonds, alternative investments, and possibly even international holdings. Digital assets continue to offer alternative growth opportunities and can serve as a buffer during periods of market volatility.

- Stay Agile in Decision-Making: In times marked by unexpected policy twists and changes in consumer trends, being ready to adapt your strategy is essential. This agility may involve shifting capital away from sectors that are bogged down by trade barriers to those more aligned with emerging tech trends.

Each of these tactics can help investors not only preserve capital but also capture growth as the economic tide changes. By staying ahead of the evolving picture of U.S. manufacturing and international regulations, you can better position your portfolio to ride the wave of digital transformation.

Tech Services: The Digital Lifeboat in an Era of Industrial Uncertainty

When assessing the current investment climate, tech services stick out as a digital lifeboat amid the overwhelming challenges faced by many industrial sectors. The rapid technological changes—especially in cloud computing and AI—mean that companies in this space are reaping unprecedented benefits from digital scalability. For those observations, historical backtests—even though specific figures like annualized returns and Sharpe ratios aren’t always available—suggest that shifts from heavy-industry sectors to tech have proven beneficial in periods marked by industrial demand weakness.

Big technology companies are now investing billions in AI infrastructure and digital innovation. For instance, Microsoft’s notable $16.75 billion conversion into AI infrastructure in Q3 2025 is just one example of how seriously tech giants are taking the transformative power of digital solutions. These moves, though sometimes seen as off-putting because of the high upfront costs, are clearly a bet on the future—a future where digital scalability and less exposure to physical supply chain disruptions offer a strategic edge.

Digital Transformation: A Closer Look at Cloud and AI

Let’s break down how cloud computing and AI are fundamentally reshaping the landscape:

- Cloud Services: Platforms like Microsoft Azure and Amazon Web Services provide scalable solutions that allow businesses to reduce their reliance on expensive physical infrastructure. The cloud is now viewed not only as a tool for data storage but also as a hub for advanced analytics, streaming services, and real-time operational intelligence.

- AI Adoption: Artificial intelligence is revolutionizing decision-making processes in business. Whether it’s through enhanced customer analytics, automated manufacturing processes, or sophisticated risk assessment, AI is proving to be essential in cutting through the confusing bits of today’s competitive market.

- Digital Resilience: Tech services companies, with their focus on intangible assets, are generally less affected by the abrupt economic shifts that can rattle sectors tied to physical production and transportation.

These advancements are not simply technological trends; they represent fundamental changes in how businesses operate. As more companies get into the digital groove, tech services will likely continue to shine as a super important area for investors looking to secure long-term growth during uncertain times.

Making Your Way Through the Industrial Maze

In the current economic climate, finding your way through the maze of industrial production, supply chain tangles, and policy twists can seem like a nerve-racking challenge. In making decisions, many investors are forced to balance the promise of high-tech innovation against the sustained importance of traditional manufacturing sectors. However, the current indicators suggest that tech services offer a much stronger platform for future growth, especially as they continue to benefit from digital transformation and a strategically favorable regulatory environment.

For many portfolio managers and private investors alike, the message is becoming clearer: while cyclical chemicals and traditional manufacturing might hold value in specific applications, the long-term growth potential is increasingly tied to the tech services sector. The infusion of digital technology, the strategic investments in cloud computing, and the ongoing adoption of AI across industries create a compelling narrative that could redefine market leadership in the years ahead.

Key Takeaways for Investors

Here are some of the critical points to carry forward:

- Sector Performance Divergence: Core durable goods are showing resilience while transportation and certain heavy industrial segments continue to struggle amid tariff-induced challenges.

- Chemicals Under Pressure: The cyclical nature of the chemical industry, combined with supply chain snags and regulatory headwinds, makes it a less attractive bet for high-growth portfolios.

- Digital Transformation as a Game-Changer: Tech services, fueled by cloud computing, AI, and digital scalability, are well poised to benefit from the profound shifts in the global economy.

- Policy and Trade Dynamics: With new tariffs and trade policies on the horizon, investors need to maintain an adaptable and well-diversified strategy to counter short-term shocks.

By keeping these takeaways in mind, investors can better figure a path through the tangled issues of today’s economic landscape and position themselves for a more resilient tomorrow.

Conclusion: Balancing Growth and Risk in a Shifting Economy

The current divergence between cyclical chemicals and tech services underscores a broader theme: in times of industrial downturn and policy-induced supply chain snags, sectors with scalable digital solutions and robust global demand shine the brightest. While traditional industries like chemicals continue to play a crucial role in areas such as clean energy and semiconductors, their exposure to unpredictable commodity swings and regulatory hurdles makes them a less attractive option for investors focused on sustainable growth.

By contrast, the tech services sector benefits from less tangible vulnerabilities and more direct access to the evolving digital economy. As companies continue to invest in cloud infrastructure and AI technologies, the promise of accelerated earnings growth becomes a compelling argument for focused capital allocation. For investors, overweighting tech services through targeted ETFs such as XLK, as well as individual holdings in digital innovation giants, offers a strategic way to leverage the fast-paced benefits of digital transformation.

In summary, the industrial maze we face today is full of confusing bits and tricky parts that require careful consideration. However, by sorting out these challenges with a balanced approach to risk management and portfolio diversification, investors can seize opportunities that align with long-term digital trends. For those willing to adapt, the transition from cyclical chemicals to tech services isn’t merely a market rotation—it’s a strategic repositioning aimed at capturing future growth in a world increasingly defined by technology and innovation.

As we continue to witness shifts in global manufacturing, trade policies, and supply chain dynamics, it becomes even more important to keep your finger on the pulse of these developments. Working through the changes with a clear strategy and a diversified mindset could very well determine not only your portfolio’s resilience but also its ability to thrive amid one of the most dynamic economic periods in recent memory.

Ultimately, investors must be ready to find their way through the tiny details, small distinctions, and fine shades of difference that define the current era. In this turbulent environment, the sector rotation toward tech services is not just a reactive measure—it is a proactive step toward embracing a digital future, one that is super important for maintaining a competitive edge and achieving long-term success.

Originally Post From https://www.ainvest.com/news/shifting-gears-investors-rotate-cyclical-chemicals-tech-services-weakening-industrial-demand-2507/

Read more about this topic at

Chemical Beats – song and lyrics by The Chemical Brothers

Chemical Beats