Distributed Control System Market: A Transformative Force in Industrial Automation

The distributed control system (DCS) market is reshaping industrial processes worldwide. As industries increasingly seek to optimize efficiency, improve safety, and enhance productivity, DCS solutions are stepping in as a must-have technology for modern plants. This opinion editorial takes a closer look at how these systems are not just a matter of technology, but a strategic enabler for digital transformation across sectors such as chemicals, energy, manufacturing, and beyond. We will explore emerging trends, highlight key challenges—including tricky parts and tangled issues—and discuss the opportunities that lie ahead.

Understanding the Foundations of Distributed Control Systems

At its core, a distributed control system is an automation framework that decentralizes control functions across modular controllers, field instrumentation, and communication networks. By allowing local control loops, operator workstations, and engineering stations to work in concert, DCS technology reduces the risks posed by a single point of failure. Whether it’s in power generation, petrochemicals, or water treatment, DCS solutions are increasingly critical in managing large-scale continuous and batch industrial processes.

This architecture is seen as essential because it delivers reliability and enhanced operational safety. In industries where continuous operation is vital, such as oil and gas or chemicals, a failure in the control system can have overwhelming repercussions. The system’s ability to offer real-time process automation ensures that even during unexpected process disruptions, the operations continue without nerve-racking downtime.

Embracing Digitalization: The Growth Trajectory of DCS

The past few years have witnessed a global digital revolution, and industrial automation is no exception. DCS is at the forefront of this digitalization trend. The proliferation of connected devices, estimated to reach over 13 billion in 2023, has laid the foundation for the successful implementation of DCS platforms. With telemetry, asset-level control, and remote operations taking precedence, the industrial world is witnessing a surge in the adoption of these sophisticated systems.

Digitalization is also being fueled by substantial public investments. For instance, national programs in the United States and funding opportunities aimed at grid modernization have provided a significant boost to the DCS market. These initiatives, coupled with substantial capital spending in regions like India, which is directing billions towards low-emission power generation and modern control systems, are catalyzing the transition towards distributed automation.

Distributed Control System Market Trends & Evolution

One of the most critical trends shaping the market is the emphasis on hardware components. In 2024, hardware held more than a 51.2% market share, with components such as controllers, input/output modules, and operator stations being at the heart of every DCS configuration. As process-intensive industries continue to expand, this critical build-out of hardware infrastructure is transforming the way that manufacturing plants and utilities manage their operations.

Another significant trend is the dominance of continuous process applications, which captured over 78.4% of the market share. Continuous operations in sectors like oil and gas, petrochemicals, and power generation demand high reliability and uninterrupted processes. This dynamic has further bolstered the need for sophisticated DCS solutions that can handle the continuous cycle of production, ensuring stable operating conditions and product quality.

Integration of Cloud-Based DCS Systems for Industrial Automation

As industries move towards digital ecosystems, the integration of cloud computing with DCS technology is one of the emerging trends to watch. This integration allows for improved remote monitoring, real-time analytics, and predictive maintenance, giving industry players the means to reduce maintenance downtime and optimize operations. Although incorporating such cloud-based systems comes with its own set of complicated pieces—such as cybersecurity and compatibility issues—it offers significant benefits in scalability and operational efficiency.

Integrating cloud-based DCS systems into existing infrastructures can be intimidating for organizations used to traditional control methods. The transition involves a series of technical steps, including the retrofitting of legacy systems and ensuring seamless communication between older and new systems. However, by carefully planning these digital shifts, companies can avoid getting stuck with nerve-racking disruptions while reaping long-term benefits.

Government Initiatives: Paving the Way for DCS Adoption

Government initiatives play a super important role in steering the DCS market forward, especially in regions like India. Programs such as the Pradhan Mantri Kisan Sampada Yojana (PMKSY) and the Production Linked Incentive (PLI) Scheme offer financial support which aids companies in modernizing food processing units and establishing robust automation systems, including DCS. These schemes deliver capital subsidies and incentives that help lighten the off-putting burden of high initial investments—often one of the most intimidating aspects of adopting new automation technologies.

For instance, the Production Linked Incentive Scheme has earmarked significant investments to boost manufacturing and export capacities. The scheme’s focus not only addresses the need for modernization but also ensures that industries benefit from state-of-the-art infrastructure improvements, driving forward the adoption of automation in critical sectors like food processing and chemicals.

Moreover, national energy investment trends underline the explosive potential of DCS upgrades. With regions like India investing billions in modernizing their energy grids and advancing low-emission power generation projects, the DCS market is positioned to experience robust growth. These investments create a favorable environment for industrial automation and grid modernization initiatives, setting the stage for widespread DCS deployment.

Government-Backed Initiatives and Their Impact on Industrial Modernization

Several government-backed programs have been instrumental in reducing the gaps in technology adoption among SMEs and large enterprises alike. Here are some key highlights:

- Pradhan Mantri Kisan Sampada Yojana (PMKSY): Aims to modernize the food processing sector from farm to retail, providing financial aid that covers anywhere from 35% to 75% of the project cost.

- Production Linked Incentive (PLI) Scheme: Encourages investment in industries, notably food processing, with an outlay of over ₹10,900 crore to generate employment and boost exports.

- National Energy Investments: Billions in investment in low-emission power generation projects and grid modernization create additional demand for DCS in critical infrastructure upgrades.

These policies not only simplify the tricky parts of implementing new technology but also guide industries through the tangled issues of legacy system upgrades and high capital expenses. With clear government support, more industries are expected to take a closer look at DCS technologies as a route for sustainable modernization.

Advantages of DCS in Managing Continuous Operations

Continuous process industries, such as power generation, chemicals, and water treatment, have seen the most significant benefits from DCS integration. The ability of these systems to deliver uninterrupted process control plays a critical role in ensuring operational efficiency. DCS systems help plants maintain stable production parameters, reduce downtime, and guarantee conformity to safety standards.

Key advantages include:

- Improved Safety Controls: By ensuring real-time monitoring and automated response strategies, DCS contributes to a safe working environment in high-risk sectors.

- Efficient Process Management: Automation of routine operations reduces human error and increases the precision of production processes.

- Enhanced Reliability: The decentralized nature minimizes single points of failure and improves resilience in the face of operational disruptions.

These systems are not free from challenges, however. The trickier parts of implementing DCS include integrating with existing legacy systems and training personnel to manage the new digital tools. Yet, the value these systems add in terms of safety, efficiency, and process stability makes them indispensable for industries that cannot afford production halts.

DCS Empowering Renewable Energy Efficiency

The transition to green energy is another arena where DCS is proving to be a game changer. As renewable energy sources like solar and wind are inherently variable, integrating DCS helps in managing these fluctuations effectively. This is not just about automating the renewable energy infrastructure; it also means optimizing the way we consume and generate energy on a large scale.

With DCS, grid operators can balance the load more effectively, integrate intermittent renewable energy sources, and reduce emissions through better monitoring and control. The improvements in energy efficiency, real-time load management, and predictive maintenance offered by distributed control systems pave the way for a greener, more reliable energy future.

Ultimately, the synergy between DCS and renewable energy initiatives is well worth the initial off-putting investment. The long-term benefits—in terms of both environmental impact and operational efficiency—far outweigh the early hurdles faced during system integration.

Challenges in Implementing Advanced DCS Solutions

Despite the promising advancements of distributed control systems, some of their implementation steps continue to present overwhelming challenges. One of the most notable issues is the substantial initial capital required to set up a state-of-the-art DCS infrastructure. Hardware, software, installation, and training expenses can place a heavy burden on small and medium enterprises (SMEs) that often operate on tight budgets.

Not only is the financial investment high, but integrating new DCS technologies with existing, outdated equipment is also a tangled issue. Many facilities currently run on legacy systems that are not equipped to conveniently merge with advanced automation solutions. Upgrading these systems involves dealing with subtle parts of compatibility and can result in temporary production halts, affecting overall output and efficiency.

Furthermore, the lack of skilled personnel capable of managing, operating, and maintaining advanced DCS components is a significant challenge. Training existing staff or recruiting new talent are necessary steps that add to the overall expense. Nevertheless, addressing these issues is essential. Failure to do so may result in missing out on long-term gains, including improved operational safety, process stability, and competitive productivity enhancements.

Tackling the Tricky Parts: Overcoming Integration and Training Obstacles

Implementing a modern DCS solution means confronting several tricky parts head-on. Here are some strategies industries are using to make the transition smoother:

- Phased Upgrades: Instead of a full-scale replacement, companies can opt for phased upgrades that gradually replace legacy hardware, easing the transition process.

- Customized Training Programs: Investing in specialized training helps to diminish the challenges associated with the new technology, ensuring that technical staff can quickly get into the nitty-gritty of the DCS systems.

- Vendor Partnerships: Collaborating with experienced vendors can provide support and guidance, helping firms figure a path through complicated integration processes.

These approaches help mitigate the intimidating aspects of DCS integration and ensure that companies can smoothly transition toward more advanced manufacturing and operational setups.

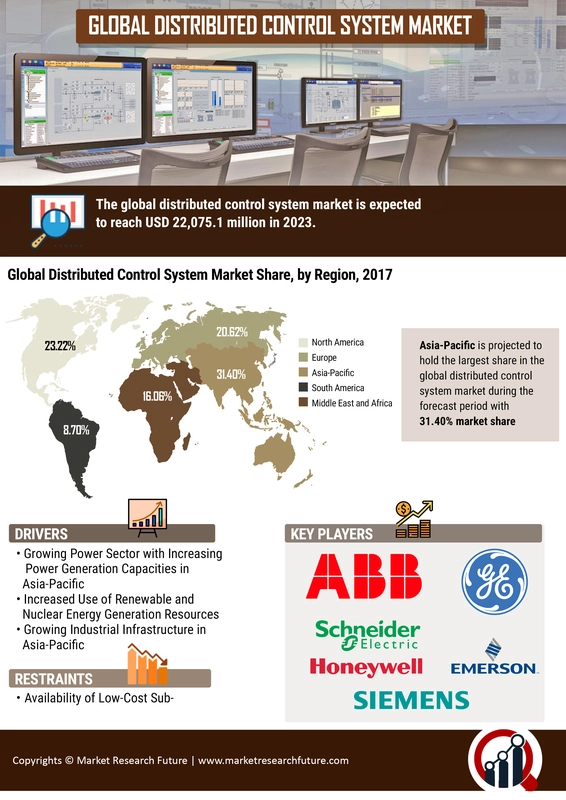

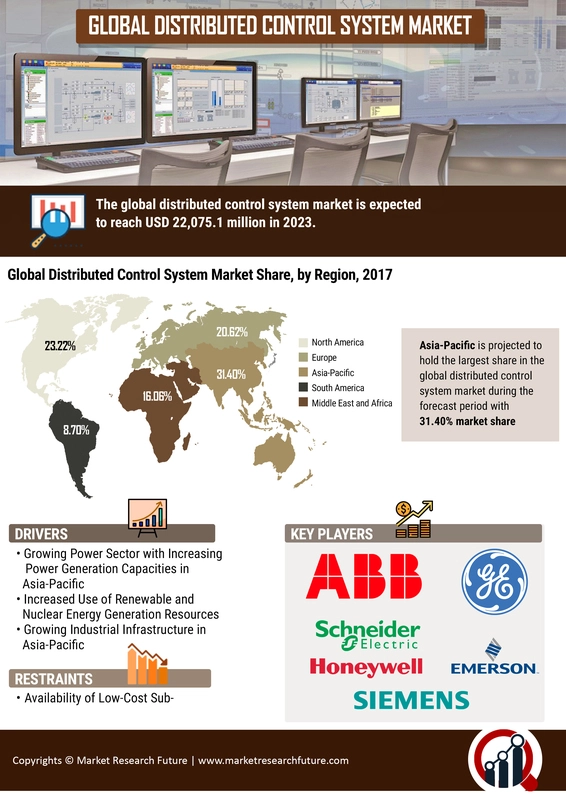

Regional Insights: Dominance and Opportunity in the Asia Pacific

Geographically, the Asia Pacific region is emerging as a powerhouse in the global DCS market. In 2024, this region accounted for approximately 42.90% of the global market share, representing about USD 8.5 billion in revenue. The dominance of Asia Pacific can be largely attributed to its strong manufacturing base and aggressive investments in energy transition initiatives.

Here are some of the factors driving significant DCS adoption in the region:

- Manufacturing Prowess: Asia is a manufacturing hub, contributing to nearly 55% of global manufacturing value added. This robust industrial activity necessitates the implementation of advanced process control systems.

- Capital Investments: Large-scale investments in grid modernization and renewable energy integration are accelerating the demand for efficient control systems.

- Government Support: Policies and subsidies aimed at modernizing industrial infrastructure are further promoting the uptake of distributed control systems among local enterprises.

To better illustrate these insights, see the table below summarizing key regional drivers:

| Key Factor | Impact |

|---|---|

| Manufacturing Prowess | High demand for automation due to extensive industrial activity |

| Capital Investments | Massive funding for grid modernization and renewable energy projects |

| Government Support | Robust policies that incentivize modern control system upgrades |

This strong foothold in the Asia Pacific is likely to further propel the global market, setting a benchmark for DCS adoption in other regions as well.

Major Industry Players and Their Strategic Moves

The DCS market is highly competitive, with leading companies like ABB, Emerson Electric Co., Honeywell, and Siemens holding dominant positions. These industry giants have continued to invest heavily in research and development, resulting in cutting-edge products that address both current and future process control needs.

For example, ABB’s flagship platforms and Emerson’s DeltaV system have demonstrated significant success by offering scalable, modular, and highly reliable solutions. Honeywell, with its Experion PKS and the innovative HIVE architecture, emphasizes flexibility and cybersecurity—an area that is becoming increasingly critical as digital threats evolve.

Other prominent players include General Electric, Valmet, Mitsubishi Heavy Industries, and Yokogawa, each contributing in unique ways to optimize automation in various industrial applications. Their combined efforts are shaping a market that is increasingly adaptable, innovative, and future-ready.

Key Strategies Employed by Industry Leaders

The leading figures in the DCS market are known for their methodical approach to overcoming the little details involved in system integration and evolving market conditions. Their strategies include:

- Investing in R&D: Continuous improvement in technology ensures that their systems can meet the demands of contemporary and future industrial scenarios.

- Modular Automation Solutions: Providing scalable solutions that easily integrate with existing infrastructure while supporting the influx of connected devices.

- Enhanced Cybersecurity Measures: Addressing potential vulnerabilities by implementing robust security protocols.

- Global Expansion: Tapping into emerging markets with tailored solutions, thereby expanding their customer base and revenue streams.

These strategies not only help simplify confusing bits and tangled issues but also encourage other players in the market to adopt a more proactive stance towards innovation and digitization.

Opportunities for Future Growth in the DCS Market

Laying out the road ahead, the prospects for growth in the DCS market are super important. As industries across the board continue to invest in modernization and automation, the opportunities presented by advanced DCS solutions are bound to multiply. The escalating integration of artificial intelligence and the Internet of Things in industrial setups heralds a future where control systems are smarter, more resilient, and deeply interconnected.

Some of the key drivers for future growth include:

- Energy Transition: The shift towards renewable energy and the need for resilient grid management will drive ongoing investments in DCS solutions.

- Emerging Markets: Increased industrialization in regions like Asia Pacific, Latin America, and parts of Africa will boost the adoption of modern automation systems.

- Digital Transformation Initiatives: As more companies embark on digital journeys, the integration of advanced control systems designed for real-time monitoring and predictive maintenance becomes super important.

These drivers, coupled with supportive government initiatives and global momentum towards cleaner, more efficient energy solutions, position the DCS market for an exciting evolution over the next decade. Industries must be prepared to work through the twists and turns of integrating these systems to maintain a competitive edge in a fast-changing landscape.

Exploring the Fine Points of Innovation in DCS

Innovation in distributed control systems is not merely about upgrading existing hardware or software components—it’s about rethinking industrial control strategies altogether. For example, the integration of artificial intelligence enables DCS platforms to predict maintenance needs before catastrophic failures occur. This capability is a transformative step in ensuring continuous operations, thereby reducing both downtime and overall operational costs.

Moreover, digital twins—virtual replicas of physical systems—are redefining how companies monitor their processes. Through continuous simulation and analysis, digital twins allow operators to take a closer look at potential shortcomings and adjust operations without risking actual production setups. These technological advances illustrate that the future of DCS is closely intertwined with broader digital transformation trends seen across industries globally.

The Business Impact: Cost Savings, Efficiency Gains, and Strategic Advantage

Companies that invest in modern DCS solutions report significant improvements in operational efficiency and cost savings. While the initial setup can be intimidating due to high capital expenditure and tricky integration issues, the long-term benefits provide a strong justification for these investments. Enhanced process control translates to more stable production cycles, reduced waste, and improved safety—all of which have a substantial impact on a company's bottom line.

For business leaders, adopting DCS technology is not just a technical upgrade—it’s a strategic move. With continuous process applications showing dominance in the market, organizations have much to gain in terms of reliability and productivity. As businesses aim to stay competitive amid rapid industrial digitalization, aligning with modern DCS solutions becomes a key driver of long-term success.

Moreover, DCS investments are increasingly recognized as essential for meeting regulatory requirements in industries that are heavily scrutinized, especially those related to environmental standards and workplace safety. As regulatory standards become more stringent, the need for reliable and efficient process control becomes super important, ensuring compliance and reducing legal risks.

Analyzing the Competitive Landscape with a Data-Driven Approach

The global DCS market, projected to grow from USD 20 billion in 2024 to an estimated USD 35.8 billion by 2034 at a compound annual growth rate of 9.2%, underscores the critical role of evolving control systems in industrial operations. Below is a summary table outlining some key market statistics and strategic focal points:

| Metric | Value |

|---|---|

| Market Value (2024) | USD 20.0 Billion |

| Forecast Revenue (2034) | USD 35.8 Billion |

| CAGR (2025-2034) | 9.2% |

| Dominant Regional Share (Asia Pacific) | 42.90% (Approximately USD 8.5 Billion) |

| Key Component Share (Hardware) | Over 51.2% |

| Application Focus (Continuous Process) | Over 78.4% |

These numbers do not only represent market size but also highlight the competitive pressures and the necessity for continuous innovation. Businesses that figure a path through these challenging bits and embrace the digital revolution are likely to enjoy both operational improvements and a strategic market advantage over competitors who remain tied to legacy systems.

Conclusion: Steering Through the Future of Industrial Automation

In summary, the distributed control system market is at a pivotal moment. With rapid digitalization, significant government initiatives, and an overarching push for renewable energy efficiency, DCS technology is rapidly becoming indispensable for modern industries. Although the journey is not without its tricky parts and overwhelming challenges, the long-term benefits in terms of improved safety, operational efficiency, and cost savings are undeniable.

For businesses seeking to make their way through tangled issues of modernization, investing in DCS solutions offers not just a technological upgrade but a strategic competitive edge. The slight differences between new and legacy systems—when managed carefully—can translate into a future where industries are more resilient, flexible, and better prepared to meet the challenges of an ever-evolving industrial landscape.

As we move forward, it remains imperative for industry leaders to stay engaged with emerging trends, invest in skill development, and form strong partnerships with technology providers. Only by taking the wheel of this transformative technology can businesses ensure they remain at the forefront of industrial automation in a digital era.

With a blend of innovation, strategic investment, and smart government policies, the DCS market is set to play a critical role in driving the next wave of industrial transformation. The path may be loaded with problems, but it is also brimming with potential for those ready to dive in and turn challenges into opportunities. Ultimately, the future of industrial automation is bright—if companies can steer through the twists and turns and embrace the exciting possibilities that modern distributed control systems offer.

Originally Post From https://market.us/report/global-distributed-control-system-market/

Read more about this topic at

Decentralized automation – economical solutions – Weidmuller

Decentralised automation with Bürkert solutions