Overview of the Recent Materials Sector Decline

The events of September 25, 2025, have cast a long shadow over the Materials sector as it experienced a -1.21% decline. This editorial takes a closer look at the underlying reasons behind this drop and examines its broader implications for the global economy. In today’s dynamic market, where investor sentiment can shift rapidly, the performance of the Materials sector stands as a key indicator of economic strength or potential headwinds. We will dig into the contributing factors, review the performance of key companies, and assess what lies ahead for an industry that plays a super important role in both business and everyday life.

The decline, although reflected in a single day’s trading, has significant meaning for investors. It acts as a mirror to the broader economic trends and encapsulates the twists and turns that characterize commodity markets. In this piece, we will take a closer look at the critical areas affecting the sector, from supply chain issues and production challenges to shifts in demand spurred by the energy transition and regulatory policies. By analyzing these diverse yet connected elements, our aim is to provide a balanced assessment of the current situation and the future outlook.

Examining the Convergence of Factors Triggering the Downturn

On September 25, 2025, various elements aligned to create a challenging day for the Materials sector. Rather than being an isolated event, the -1.21% drop reflects several converging elements that had been building up for some time. These include interruptions in supply chains, fluctuations in demand for certain commodities, and strategic missteps from major players in the industry.

One of the key highlights of the day was the dramatic impact of supply disruptions on industrial metals. For example, copper prices spiked on the London Metal Exchange and India’s Multi-Commodity Exchange. This surge came on the heels of a force majeure declared by Freeport-McMoRan after a fatal mudslide at its Grasberg mine in Indonesia. The incident, which caused a significant interruption in supply, serves as an example of how sudden environmental and operational mishaps can send shock waves across the market, altering price expectations and investor confidence.

Other factors also came into play. While gold futures remained largely flat in anticipation of U.S. inflation data, silver experienced record highs, driven by robust demand in sectors such as solar, electric vehicles, and 5G. In addition, aluminum and zinc futures showed regional strength, particularly in India, even though overall sentiment in the sector was on edge.

Key Supply Chain Issues and Operational Disruptions

When we talk about supply chain woes in the Materials sector, we are really getting into the nitty-gritty of how external events quickly morph into market-wide effects. The incident at Freeport-McMoRan’s Grasberg mine is a prime example of how environmental issues, such as a fatal mudslide, can lead to a complete shutdown in operations. Investors reacted sharply, and the company saw its stock drop by nearly 12–17% almost instantly. Such a dramatic response underscores the nerve-racking impact that supply interruptions can have on a company’s forecast and overall market performance.

Other companies, like German specialty chemicals giant Evonik, have also faced their own operational difficulties. With weak consumer demand and an absence of a robust economic recovery weighing them down, even resilient companies have had to revise their outlooks. Evonik, in particular, adjusted its full-year 2025 EBITDA forecast downward, which in turn influenced market sentiment across the board.

Bullet Points of Contributing Factors

- Force majeure declarations disrupting production at key mining sites

- Price volatility in industrial metals, with copper and silver affected differently

- Weak demand indicators in the chemicals segment, especially noted by major companies

- Global economic indicators painting a picture of mixed performance: strong consumer spending but a decline in private goods-producing industries

- External geopolitical tensions and environmental challenges compounding supply chain pressure

Financial Health and Investor Sentiment in a Cautious Market

Investor sentiment is incredibly important in a market that is defined by its ever-changing environment. On September 25, 2025, widespread negativity was evident as U.S. stock indexes closed lower for a third consecutive session. This overall market mood was not solely dictated by the drop in the Materials sector; it was a cumulative effect of astonishing global economic data, central bank commentary, and company-specific news causing a ripple effect across multiple sectors.

Investors are particularly cautious when economic indicators appear on edge. For instance, the U.S. Bureau of Economic Analysis revised Q2 2025 GDP data upward, which might initially suggest strength. However, the simultaneous 0.9% decline in private goods-producing industries created a mixed picture. Such data, when combined with central bank officials’ remarks about “fairly highly valued” stocks, tends to create a tense market environment. In times like these, portfolio reallocation moves become more common, as investors decide to steer through these confusing bits by shifting their assets away from growth-sensitive investments.

Analyst Opinions: A Mixed Bag

Financial analysts have been mixing optimistic long-term views with cautious short-term forecasts. Although some market experts believe that the dip is nothing more than a technical correction, others are viewing it as a reflection of deeper issues in industrial output and commodity price cycles. With several companies in the Materials arena having to contend with both regional and global challenges, predicting the immediate rebound remains difficult.

Here is a summary of the key opinions on the market movements:

- Many analysts expect a rebound if global economic data and monetary policies improve.

- Some experts worry that persistent interest rate hikes and geopolitical challenges might prolong the downturn.

- There is an overall consensus that while the short-term outlook is nerve-racking, the long-term prospects driven by the energy transition and infrastructure spending remain super important.

Company-Specific Performance: Winners and Losers in the Spotlight

The heterogeneous performance of individual companies within the Materials sector has painted a complex picture. Several industry leaders have been affected in different ways by the market turbulence. A detailed look at these companies provides insights into which players may be better positioned and which are currently dealing with sizable setbacks.

Freeport-McMoRan: A Hard-Hit Leader

Freeport-McMoRan, a global powerhouse in copper and gold mining, faced severe setbacks when the incident at its Grasberg mine forced a full cessation of operations. The company’s operational disruption led to an expected 35% drop in production for 2026 compared to previous forecasts, and a full recovery is not expected until 2027. The resulting stock plunge, with a decline estimated between 12% and 17%, has led to downgrades by major analysts who now forecast reduced EBITDA and NAV per share. This situation is a clear example of how quickly external events — from environmental disasters to operational mishaps — can impact a company’s market standing.

Evonik: Adjusting Outlooks Amid Weak Demand

German chemicals giant Evonik has not been spared either. The company opted to revise its financial guidance downward, lowering its full-year 2025 adjusted EBITDA forecast to around €1.9 billion. Given the persistently weak demand and an atmosphere that is loaded with issues surrounding economic recovery, the company’s shares dropped by nearly 1.29% upon the announcement. This performance demonstrates the challenging environment in the chemicals segment, where even super important companies are finding the current market conditions to be overwhelming.

Lithium Producers: Mixed Fortunes for Lithium Americas and Liontown Resources

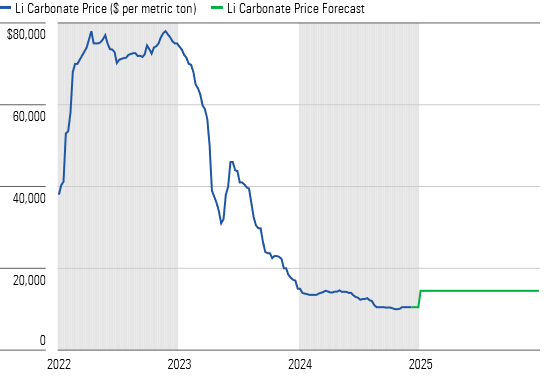

Lithium has long been heralded as a key asset for the future of energy storage and electric vehicles. However, the short-term market dynamics for lithium remain unpredictable. Companies like Lithium Americas and Liontown Resources are experiencing a mixture of setbacks and promise. Although long-term outlooks remain positive due to the growing demand for electric vehicles and battery storage, the companies have faced immediate challenges such as softer lithium prices and market volatility. Liontown Resources, for instance, reported a substantial loss in its full-year FY2025 results, triggering a 3% drop in share price even while it maintained positive underlying EBITDA from its Kathleen Valley project. Analysts continue to rate these stocks as underperformers in the face of current turbulence.

Table: Company Impacts at a Glance

| Company | Key Issue | Market Impact | Outlook |

|---|---|---|---|

| Freeport-McMoRan | Force majeure at the Grasberg mine due to environmental issues. | Stock drop of 12-17% and production cut by 35% in 2026. | Recovery expected only by 2027. |

| Evonik | Revised EBITDA forecast due to persistent weak demand. | Shares fell by 1.29%. | Challenged by global economic and demand issues. |

| Lithium Americas & Liontown Resources | Softer lithium prices and short-term market volatility. | Mixed performance with significant losses reported by Liontown Resources. | Long-term demand remains strong but immediate outlook is cautious. |

Understanding the Supply-Demand Dynamics Amid the Energy Transition

One cannot ignore the long-term trends shaping the Materials sector. In particular, the energy transition is driving radical changes in the demand for various commodities. While there is growing need for so-called “green metals” like copper, nickel, and lithium, the recent decline in the sector might reflect temporary challenges in scaling up production to meet this demand. The current market environment, loaded with issues from geopolitical tensions and unpredictable supply chain twists and turns, presents a tricky landscape for companies trying to balance immediate pressures with long-term ambitions.

The energy transition is directly responsible for pushing companies to invest in advanced materials and reduce their environmental footprints. Investors have been keenly watching these trends, as the promise of sustainable growth contrasts sharply with the recent volatility. Even as some parts of the Materials sector experience short-term setbacks, the long-term potential remains strong, provided that companies can find a way through the tangled issues of production bottlenecks and regulatory challenges.

Strategies for Managing the Demand-Supply Gap

Companies that desire to figure a path through these challenging times are focusing on several strategic pivots. These include:

- Investing in research and development to create innovative production methods.

- Reshoring and friendshoring efforts to reduce reliance on volatile international supply chains.

- Enhancing digitalization and automation to better predict demand and prevent overproduction.

- Decoupling production strategies by diversifying commodity portfolios.

- Prioritizing sustainable and circular models which practitioners believe can eventually lead to stabilizing costs.

These tactics are not without their own set of confusing bits and challenging twists. Yet, firms that successfully execute them are likely to come out ahead as the energy transition continues to redefine the market landscape. As critical as these strategies are, companies must remain agile and responsive, continually adjusting to subtle details in supply and demand dynamics.

Policy and Regulatory Impacts on the Materials Sector

Government policies and evolving regulations have had a profound impact on the Materials sector. Rising concerns about environmental impact, heightened scrutiny of supply chains, and evolving trade policies all contribute to market instability. Regulatory moves—such as stricter environmental standards on substances like PFAS and trade measures like U.S. tariffs on Chinese critical mineral imports—can trigger rapid changes in commodity prices and production plans.

The regulatory landscape is especially tricky because it not only affects current operational costs, but it also shapes the strategies that companies must adopt to find their way in a competitive global market. When regulatory frameworks tighten, companies may face off-putting investments in new compliance measures, which can compress profit margins. Conversely, regulatory pushes for domestic production and supply chain diversification may offer new opportunities by reducing foreign dependency, despite temporarily driving up costs.

The Role of Central Bank Policies

In addition to direct regulatory impacts, monetary policies set by central banks play a super important role in shaping the sector’s performance. Recently, hawkish moves aimed at controlling inflation by raising interest rates have contributed to reduced demand for materials by making financing more expensive. While these policies are intended to stabilize the broader economy, they often have the unintended consequence of adding to the already nerve-racking pressure on industries that rely heavily on cyclical investments.

Central bank policies create a ripple effect across various industries—from manufacturing to construction—and serve as a reminder that the Materials sector is invariably linked to the trajectory of overall economic health. Investors and company executives alike must continuously monitor their favorite economic indicators, including GDP growth, inflation rates, and manufacturing output figures, to ensure they are well prepared to steer through future challenges.

Future Outlook: Balancing Immediate Concerns with Long-Term Growth

Looking ahead, the Materials sector faces a dual narrative. In the short term, lingering risks resulting from supply chain disruptions, volatile commodity prices, and geopolitical tensions are likely to keep investors cautious. However, many in the industry are optimistic about the long-term potential of the sector due to underlying fundamental shifts driven by the energy transition and technological advancement.

The immediate future may require companies to work through some intimidating hurdles and confusing bits, such as managing further rate hikes and refining production strategies in the wake of recent operational setbacks. Many analysts suggest that a combination of global monetary easing and a recovering Chinese economy later in 2025 could help spark a rebound in materials demand, particularly in critical areas tied to infrastructure and green technology.

Potential Future Scenarios

There are a few possible paths where the sector might be headed in the near term, each with its own set of challenges and opportunities:

- Recovery Scenario: With global monetary easing and increased infrastructure investments, the sector could experience a rebound. Stocks might rebound as investors respond to favorable GDP data and lowered interest rates.

- Stagnation Scenario: Should geopolitical tensions persist along with supply chain interruptions, the sector could see a flat or sluggish performance. This scenario entails prolonged periods of subdued demand and continued cautious investment strategies.

- Further Decline Scenario: Although less likely, a deep global recession combined with an oversupply of commodities and enduring geopolitical strife could drive further declines in the sector. High interest rates and intensified trade wars might compound the challenge.

Companies that decide to take the wheel and strategically pivot may position themselves not only to withstand short-term turbulence but also to benefit appreciably in the medium to long term. This requires a careful mix of cost control, smart investments in innovation, and proactive responses to policy changes. Investors should look for signs that indicate a company’s ability to manage its tangled issues, such as robust balance sheets, diversified sourcing strategies, and adaptive operational models.

Key Strategies for Future Success

In order to adapt successfully to the evolving challenges, companies in the Materials sector should consider the following approaches:

- R&D Investment: Commit to research and development to discover advanced materials and more efficient production techniques.

- Supply Chain Resilience: Reorganize supply networks to reduce dependency on volatile markets and manage those tricky parts of global sourcing.

- Digital Transformation: Implement digital tools and automation to get into the fine points of demand forecasting and to manage production loads efficiently.

- Regulatory Readiness: Stay ahead of changes in environmental and trade regulations to mitigate the risk of off-putting compliance costs.

- Sustainability Focus: Embrace circular economy principles and sustainable practices to secure long-term competitiveness, especially as global emphasis on green production intensifies.

Implications for Other Sectors and Overall Economic Health

The decline in the Materials sector does not exist in a vacuum. Its effects are woven through the fabric of other industries and, in many ways, serve as an early warning sign for broader economic trends. For instance, manufacturing, automotive, and construction sectors are all likely to feel the pinch of rising raw material costs, leading to decreased profit margins and delayed project timelines.

In the automotive sector, for example, the pursuit of electric vehicles (EVs) depends heavily on a reliable supply of advanced materials. Any disruption or prolonged instability in the Materials market can result in increased component prices, which may slow down the pace at which new vehicles are produced or adopted. Similarly, in the construction industry, volatile prices for essential materials such as cement, lumber, and steel can put projects on hold or force companies to rework their cost structures.

The Ripple Effects on Global Industries

Other industries are also likely to feel the tension. Here are some key sectors where the impacts of the Materials decline may be particularly pronounced:

- Automotive and EV Manufacturing: Increased component costs can reduce competitiveness and delay fleet renewals.

- Construction and Infrastructure: Project timelines may extend as companies grapple with sudden price surges in construction materials.

- Electronics and Semiconductors: The tech sector depends on a stable supply of various industrial metals, and price fluctuations can lead to supply shortages or production delays.

- Chemicals and Specialty Materials: Shifts in quality and price can trigger operational adjustments, affecting everything from product innovation to market expansion strategies.

The interconnectedness of these sectors means that a sustained downturn in the Materials industry could have a cascading effect on global trade and economic growth. As a result, policymakers and industry leaders must work together to figure a path through these challenging times, ensuring that strategies account for both immediate price volatility and long-term industry resilience.

Investor Recommendations: Keeping an Eye on the Fine Details

For investors, the lessons from September 25, 2025, are clear: the Materials sector’s performance is a telling barometer of broader economic trends, and shifts in this field can signal emerging problems or opportunities across multiple sectors. In these uncertain times, it is important to find your way through with a careful, well-informed investment strategy that takes into account both the current market challenges and the potential for long-term growth.

Some key pointers for investors include:

- Monitor Economic Data Closely: Keep track of GDP trends, manufacturing outputs, and inflation figures, as these subtle details can influence market expectations.

- Assess Company-Specific Strengths: Look for businesses with strong balance sheets, diversified supply chains, and proactive management strategies.

- Stay Updated on Policy Changes: Changes in trade policies, environmental regulations, and central bank decisions can dramatically alter market conditions.

- Be Prepared for Market Volatility: Understand that cyclical industries like materials can be subject to nerve-racking swings, and diversify investments to manage risk.

- Plan for the Energy Transition: Companies that are investing in sustainable production practices and advanced materials are likely to be on the right side of history.

While there is inherent risk in any investment, those who keep an eye on these key factors are better positioned to make informed decisions. In times of market turbulence, staying grounded and attentive to the little twists in the data—and in company performance—can be the difference between a well-managed portfolio and a series of costly missteps.

Conclusion: Balancing Immediate Challenges with a Promising Long-Term Outlook

The materials sector’s -1.21% drop on September 25, 2025, is a reminder of the high stakes and ever-changing nature of global markets. The interplay between environmental mishaps, supply chain interruptions, and shifting demand patterns has created a scenario that many find intimidating. However, by taking a closer look at the broader picture, one can see that the challenges faced today are just one part of a larger, evolutionary process in the global economy.

In conclusion, the present decline should be understood within the context of both its short-term impacts and its long-term opportunities. As companies work through their tangled issues and policymakers adjust regulations to meet new industrial realities, the Materials sector is likely to remain a super important indicator of economic health. Its performance will continue to influence industries ranging from automotive manufacturing to construction, making it essential for investors, executives, and policymakers alike to keep a close watch on its developments.

Ultimately, while investors may be anxious about the immediate headwinds, those with a long-term perspective will recognize that the energy transition, increased globalization of supply chains, and advancements in digital production technologies all point toward a future where the Materials sector not only recovers but thrives. Success will depend on the ability of companies to manage the tricky parts, adapt to regulatory changes, and strategically reallocate resources in this ever-competitive, high-stakes market.

The recent market drop serves as a wake-up call—a moment for businesses to get into the fine points of operational resilience and for policymakers to refine strategies that ensure a robust economic foundation. For the investor community, knowing how to make well-informed decisions today may lead to rewarding opportunities tomorrow. While the path ahead is loaded with challenges, those who actively work through these issues and look for strategic pivots will find a landscape ripe with opportunity, even amidst uncertainty.

Originally Post From https://markets.financialcontent.com/stocks/article/marketminute-2025-9-26-materials-sector-slides-as-global-economic-concerns-mount-a-deep-dive-into-september-25-2025s-121-decline

Read more about this topic at

Materials Sector Slides as Global Economic Concerns Mount

Materials sector outlook 2025 | Materials stocks