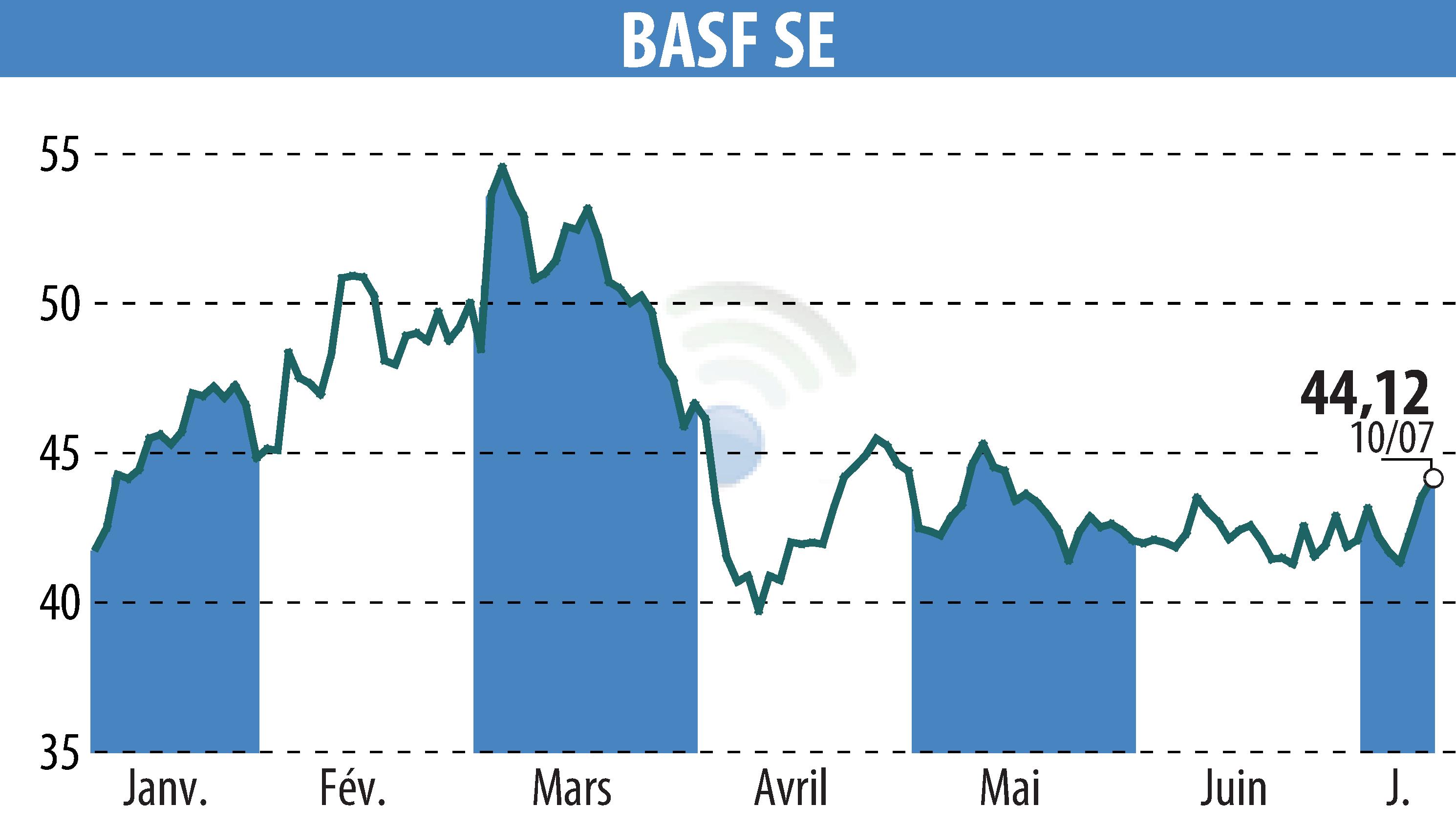

BASF Q2 2025 Preliminary Figures: A Closer Look at the Trends and Challenges

The BASF Group’s recent second-quarter report for 2025 has sparked discussions among market watchers and industry insiders alike. In a period marked by negative currency effects and lower prices—factors that have contributed to a slight decline in sales—the company has also witnessed encouraging volume growth in segments like Agricultural Solutions and Surface Technologies. As we take a closer look at this report, we will explore the tricky parts of the data, analyze the underlying economic currents, and touch on the subtle shifts shaping the future of chemical production and industrial manufacturing.

In this opinion editorial, we will dig into the key figures, highlight the hidden complexities amid restructuring costs, and discuss the industry’s reaction to a more intimidating and uncertain economic environment. Throughout, we will use everyday language and plain descriptions to help readers figure a path through the twists and turns of the latest market news.

Understanding BASF’s Sales Performance in Q2 2025

BASF’s Q2 figures showed a decline in sales by 2.1%, coming in at €15.77 billion compared to €16.11 billion in Q2 2024. This drop was largely due to negative currency effects all across various segments and the downward pressure on prices—especially noticeable in the Chemicals segment. It’s important to note that while sales weakened slightly, volumes increased, thanks mainly to robust growth in the Agricultural Solutions and Surface Technologies segments. For many in the industry, this seems to be a sign that while top-line revenue is under pressure, the underlying demand for BASF’s products continues to grow in specific areas.

The figures indicate that analysts had expected average sales of about €15.80 billion for Q2 2025. That close proximity to analyst predictions, however, should not distract from the fact that certain segments are faring better than others, and that factors such as restructurings and lower prices are beginning to take their toll on profitability.

Currency Effects and Lower Prices: The Tricky Parts

The effect of negative currency movements and lower prices has been one of the most talked-about topics in the report. In simple terms, when currencies move unfavorably, companies like BASF find that their numbers shrink even if the actual demand for their products remains strong. This is one of those tangled issues that can mask the underlying health of a business when one only looks at the top-line numbers.

- Negative Currency Effects: These have diminished the euro-denominated revenue, making comparative figures less favorable compared to the prior-year quarter.

- Price Pressure: Lower prices, especially in key segments like Chemicals, are squeezing margins and limiting potential growth in profitability.

While these are complicated pieces of the overall picture, it is clear that BASF’s management must now work through these small distinctions in pricing strategy and currency risk management in order to maintain competitiveness in a loaded market environment.

Segment Performance: Highlighting Growth Amid Pressure

A closer examination of the various segments provides some insights into where the company is performing well and where it is seeing setbacks. Two segments in particular—Agricultural Solutions and Surface Technologies—reported satisfyingly higher volumes, with Agricultural Solutions even recording a jump in EBITDA before special items that surpassed the highest analyst estimates.

Conversely, segments such as Chemicals and Industrial Solutions struggled considerably, with EBITDA before special items falling notably short of last year’s figures. This uneven performance reflects the many small twists in market demand and underlying economic shifts that different segments face.

| Segment | Key Observations |

|---|---|

| Agricultural Solutions | Volume growth and significant EBITDA improvement |

| Surface Technologies | Slightly higher EBITDA compared to the prior-year quarter |

| Materials | Marginal decline in EBITDA before special items |

| Chemicals & Industrial Solutions | Marked decline relative to previous period |

This table underscores the fact that even within a global group like BASF, not all parts of the business react equally to external price and currency shocks. It is these subtle parts of the operational mix that investors and market analysts keep a close eye on.

Restructuring Costs and Special Items: The Hidden Complexities

BASF’s report also pointed out that special items within EBIT–mostly derived from restructuring costs—are playing a significant role in the final profitability numbers. These restructuring charges are part of an ongoing cost-saving drive, intended to sharpen the company’s competitive edge in a market that is both loaded with issues and evolving rapidly.

For those following BASF’s progress, the restructuring costs present a potential double-edged sword. On one side, they are investments in streamlining operations for the future. On the other, they have a direct, short-term impact on profitability figures, as evidenced by the lower than expected EBIT of €0.49 billion in Q2 2025 compared to analysts’ expectations of around €0.70 billion.

The situation is similar when we look at net income, which reached an expected €0.08 billion – a clear drop from the prior-year quarter figures driven by higher income taxes and reduced contributions from equity investments. It is one of those nerve-racking adjustments that remind us of the fine balance companies must strike between cost-cutting and long-term growth investments.

Profitability Pressures and Earnings Adjustments

It is worth noting that while BASF’s EBITDA before special items came in at an expected €1.77 billion—aligning with analyst forecasts—this figure fell short of last year’s performance which was about €1.96 billion. The mixed results across various profitability metrics raise questions about future earnings potential in a competitive and uncertain market.

Another important figure is the group’s EBIT before special items, which stands at an anticipated €0.81 billion. Even though this figure is slightly above the average analyst prediction (around €0.78 billion), it marks a significant drop compared to Q2 2024’s €0.97 billion. For seasoned industry observers, these numbers underline the challenge of maintaining healthy margins while contending with both external and internal cost pressures.

Furthermore, with net income estimated to be around €0.08 billion—drastically lower than analysts’ predictions and the previous year’s €0.43 billion—BASF faces an uphill battle in terms of margin recovery. Higher tax expenses and a reduction in supporting equity investments contribute to this less-than-stellar performance, forcing the company to reckon with some of the confusing bits present in strategic planning during volatile market conditions.

Free Cash Flow: Strength Amid Uncertainty

On a brighter note, BASF’s free cash flow appears to be on slightly more positive ground. Report expectations indicate a free cash flow of about €0.53 billion in Q2 2025—a bit higher compared to €0.47 billion in Q2 2024. This improvement comes despite an expectation of lower cash flows from operating activities and reduced capital expenditure on property, plant, equipment, and intangible assets.

This improvement in cash flow is a crucial point for investors. It serves as a reminder that while headline numbers like net income are important, operational cash flow metrics can sometimes tell a more reassuring story about the company’s resilience and short-term operational health.

Looking Ahead: Adjusting to a Shifting Macroeconomic Environment

The outlook for 2025 has been adjusted by BASF as the company recalibrates its assumptions amidst ongoing macroeconomic and geopolitical uncertainties. According to the new guidance, the global gross domestic product is projected to grow at a slower pace than previously anticipated—a development linked largely to U.S. tariffs introduced earlier in the year and the subsequent market uncertainties these tariffs have spurred.

In addition, the U.S. dollar has depreciated significantly against the euro, and the anticipated slowdown in global industrial production presents further challenges. For a company heavily involved in chemical production, these factors add a layer of complicated pieces to the strategic puzzle that management must solve.

BASF’s revised outlook sets expectations for various key economic indicators. For instance, the company now anticipates:

- GDP growth between 2.0% and 2.5% (down from 2.6%)

- Industrial production growth between 1.8% and 2.3% (down from 2.4%)

- Chemical production growth between 2.5% and 3.0% (previously anticipated at 3.0%)

- An average annual euro/dollar exchange rate at $1.15 per euro (higher than the earlier $1.05)

- An average annual oil price (Brent crude) of $70 per barrel (a slight decline from $75 per barrel)

These projections are a clear indicator of the many small distinctions that market participants must consider when assessing BASF’s performance and future prospects. Such adjustments are not just numbers on a page—they are reflective of a business environment that is loaded with problems and unpredictable twists and turns.

Impact on Earnings Development and Margin Pressures

With the revised macroeconomic outlook in place, BASF expects its earnings development to be weaker than its previous forecasts for the full year 2025. The company now projects that EBITDA before special items will fall between €7.3 billion and €7.7 billion, a noticeable downshift from the earlier forecast range of €8.0 to €8.4 billion, and slightly below the analyst consensus of €7.6 billion.

Meanwhile, for free cash flow, the outlook remains within the range of €0.4 billion to €0.8 billion—a figure that reflects the balancing act required given the anticipated lower capital expenditures and the overall cautious stance due to market uncertainties. It is these fine shades of revenue and margin pressures that highlight the intricate balance BASF must maintain while trying to steer through an economic landscape that is at times full of problems and at other times reassuringly resilient.

Industry Reactions and Broader Market Implications

Industry observatories have taken a keen interest in BASF’s latest quarterly performance, not only due to the arithmetic of sales and profit but because these figures carry broader implications for the global chemical market. Many experts believe that the observed decline in sales and profitability in key areas offers a window into the broader trends that are affecting industrial manufacturing and chemical production worldwide.

For businesses in the automotive, electric vehicles, and industrial manufacturing sectors, these figures are a reminder of the interconnected nature of global supply chains and the influence of macroeconomic headwinds, such as currency volatility and fluctuations in oil prices. The report underscores the need for companies to find your way around currency risk and to reexamine pricing strategies, especially in sectors where margins are already being squeezed by various external forces.

Comparative Analysis With Prior-Year Figures

A look back at Q2 2024 reveals many of the subtle details that now come into sharper focus when compared to 2025. For instance, while sales and operating figures were robust a year ago, the current quarter’s performance highlights how factors like higher income taxes and restructuring expenses can turn minute differences into larger stories that shape investor sentiment across industries.

Some of the main disparities between the current and prior-year quarters include:

- Sales: A decline of 2.1% illustrates the effect of short-term economic pressures.

- EBITDA Before Special Items: A notable drop in profitability, signaling increasing cost pressures in certain segments.

- Net Income: A significant fall largely due to heavier tax burdens and altered equity contributions.

Such differences might seem small at first glance, but they are laden with fine points that hint at the shifting dynamics of a market that is increasingly tense and awkward to predict with certainty. In many ways, these changes exemplify the ongoing challenge of managing within an economic framework that is sensitive to both global events and sector-specific developments.

The Role of Operational Efficiency and Strategic Restructuring

The ongoing cost-saving initiatives and restructuring programs are central to BASF’s strategic response in this era of economic uncertainty. While such efforts often mean incurring short-term costs, industry experts argue that these are essential steps aimed at ensuring operational efficiency over the long haul. Indeed, the management’s focus on restructuring underscores an effort to trim the fat and to position the company so that it can quickly adapt to unexpected shifts in the market.

There are several tactical moves being employed:

- Operational Streamlining: Reducing costs in internal processes to preserve margins.

- Focus on High-Growth Segments: Leveraging strong performance in Agricultural Solutions and Surface Technologies to offset weaknesses elsewhere.

- Currency Risk Management: Adopting hedging strategies to deal with the confusing bits of currency volatility that affect reported revenues.

- Capital Efficiency: Adjusting expenditures to improve free cash flow and maintain liquidity.

These measures may appear nerve-racking to some, but they represent a critical part of how large industrial firms work their way through periods that are off-putting and filled with unpredictable twists and turns. For stakeholders, understanding these subtle parts of business planning is a must-have element of long-term strategic thinking.

Long-Term Strategic Implications for the Chemical Sector

BASF’s performance is not just an isolated incident in the broader economic context—it is a reflection of some of the key trends that are shaping the entire chemical industry. With a cautious outlook for 2025 and a continued pressure on margins, companies across the industry are having to reexamine everything from supply chain management to pricing strategies.

This is what many market analysts call “the fine shades of economic recalibration,” where even the slight differences in projected growth rates matter a great deal. In particular, the downward revision of GDP and industrial production growth forecasts signals to industry players that the landscape is shifting and that there will be a need for more conservative planning and underlying flexibility in operations.

For companies that supply raw materials to sectors such as automotive and electric vehicles, these conditions could lead to adjustments in production volume, investment in new technologies, or even changes in how they view long-term capital expenditures.

Market Research and Expert Opinions: Reading the Signals

In the wake of these recent reports, it is essential for industry watchers to dig into various market research documents, infographics, and detailed financial profiles that shed light on what these numbers truly mean. A deep dive into the data can help separate the small distinctions between what are temporary setbacks and what might be lasting changes in the market.

Several expert opinions from thought leaders have begun to highlight these points:

- Market Analysts: Point to the changes in operating income and net profit margins as indicative of broader global economic shifts.

- Industry Commentators: Emphasize the importance of flexible restructuring plans and operational efficiencies, especially in today’s tricky economic climate.

- Financial Advisors: Recommend close monitoring of cash flow indicators as key signals for future investment decisions.

These voices provide a well-rounded perspective on the situation, allowing investors and other stakeholders to get a closer look at the market’s subtle details and to figure a path through the somewhat unpredictable financial waters that define today’s industrial landscape.

Data Visualization and Comparative Metrics

To better understand the story behind BASF’s numbers, consider the following table summarizing key comparative metrics between Q2 2024 and Q2 2025:

| Metric | Q2 2024 | Q2 2025 (Expected) |

|---|---|---|

| Sales (Billion Euros) | €16.11 | €15.77 |

| EBITDA before Special Items (Billion Euros) | €1.96 | €1.77 |

| EBIT before Special Items (Billion Euros) | €0.97 | €0.81 |

| Net Income (Billion Euros) | €0.43 | €0.08 |

| Free Cash Flow (Billion Euros) | €0.47 | €0.53 |

This comparative layout helps illustrate the subtle differences from one period to the next. Even though the free cash flow shows a modest improvement, other metrics like net income and EBITDA indicate that the path ahead will require diligent management of costs and strategic investments.

Implications for the Broader Industrial and Manufacturing Sectors

The repercussions of BASF’s quarterly performance extend well beyond the company itself. For many in the industrial manufacturing and automotive sectors, the reported figures demonstrate how even major players are contending with a mix of positive volume trends and negative financial indicators. This kind of mixed news is not uncommon in an environment where global supply chains face challenges such as fluctuating oil prices and unpredictable exchange rates.

For instance, automotive manufacturers and electric vehicle producers rely heavily on chemical suppliers for advanced materials such as specialty coatings and energy-curable inks. Price pressures in the chemicals segment could, therefore, have ripple effects across these supply chains, subtly influencing manufacturing costs and even product pricing on the consumer end. These are some of those little twists that drive home the point: industry interdependencies have grown more complicated as global markets become more integrated and yet more on edge.

- Automotive Impact: The drop in chemical margins may lead to price adjustments in coatings and specialty chemicals, which are critical for vehicle durability and performance.

- Electric Vehicle Market: Reliance on advanced materials means that these sectors also face potential shortages or cost escalations if supply chain issues persist.

- Industrial Manufacturing: Fluctuating demand for inputs like additives and pigments can force manufacturers to rework production plans and adapt to price changes rapidly.

These interconnected issues are both full of challenges and key indicators of how integral sound financial planning is for industries reliant on chemical inputs. As companies figure out strategies to make their way through these choppy waters, collaborative efforts and an emphasis on operational efficiencies become essential components of long-term success.

Adapting to Economic Uncertainty: Strategic Considerations

Given the revised outlook for 2025, BASF and its peers in the industry are expected to recalibrate their strategies in the coming months. Below are some strategic considerations for companies facing this intimidating environment:

- Improve Currency Hedging: Strengthening approaches to manage stray currency risks can help mitigate the confusing bits of revenue contraction when adverse exchange rate moves occur.

- Optimize Operational Efficiency: Focusing on lean management and process optimization can help counteract the effects of restructuring costs and make the most of available resources.

- Diversify Product Portfolios: Investing in high-growth segments like Agricultural Solutions can provide a buffer against setbacks in areas like Chemicals or Industrial Solutions.

- Enhance Cash Flow Management: Close monitoring of free cash flow allows companies to ensure they remain agile in an environment that is often loaded with issues and variable market dynamics.

Each of these measures represents more than just a tick in the box—they are essential steps to finding your path in an era of economic uncertainty. Companies that can take a closer look at these aspects are likely to weather the upcoming storms and emerge stronger in the long run.

The Road Ahead: Managing Through Geopolitical and Macroeconomic Changes

As businesses across the globe continue to grapple with macroeconomic uncertainties and geopolitical tensions, the challenges are many and the twists and turns of the market are increasingly unpredictable. BASF’s outlook revision serves as a microcosm of broader trends that affect not only the chemicals sector but also industrial manufacturing, automotive industries, and even the emerging electric vehicle space.

With U.S. tariffs now playing a noticeable role in shaping buyer behavior and production costs, industry participants are judged by their ability to adapt. Here are some of the key economic adjustments that will likely dominate discussions in the months ahead:

- GDP Growth Revision: With the forecast now lowered to between 2.0% and 2.5%, companies must prepare for slower overall economic momentum.

- Industrial Production Slowdown: A predicted reduction in growth to 1.8% – 2.3% calls for careful recalibration of manufacturing schedules and capacity planning.

- Chemical Production Rates: While modest, the anticipated growth in chemical production requires continuous monitoring to ensure capacity meets evolving demand patterns.

- Exchange Rate Fluctuations: Adjustments in forex projections force businesses to get into more precise, short-term financial planning to manage revenue risks.

- Adjustments in Energy Prices: Lower anticipated oil prices might provide some relief but could also mean tighter margins in energy-dependent production processes.

Each of these points represents the kind of subtle details that, when combined, form the broader mosaic of today’s economic landscape. As we witness these changes unfold, industry experts suggest that adopting a cautious yet proactive stance is one of the best ways to surmount the challenges ahead.

Market Opportunities Despite an Intimidating Outlook

Every challenge presents an opportunity. In light of these reflecting figures and the trending slowdown in certain macroeconomic indicators, many in the industry are now turning their attention to emerging opportunities. Notably, segments such as Agricultural Solutions and Surface Technologies are paving the way for new growth avenues.

- Technological Advancements: Innovations in energy-curable materials and lab equipment are helping companies improve efficiency and cut production costs.

- Sustainability Initiatives: Environmental and regulatory pressures are driving companies to invest in sustainable production technologies, which could, in turn, lead to improved margins and market differentiation.

- Niche Market Expansion: Specialty ink formulations, particularly for digital and printed electronics, are creating new channels for revenue growth—pushes that many see as key to diversifying product lines in an unpredictable market.

While the outlook may seem overwhelming at times, these emerging areas provide a glimmer of hope. The industry is steadily learning how to take a closer look at the underlying trends and to reallocate resources towards segments that promise stable long-term returns.

Final Thoughts: Keeping a Steady Hand on the Wheel

The BASF Q2 2025 report offers a detailed snapshot of an industry in the midst of change. Even as sales figures reflect the small distinctions wrought by negative currency effects and lower prices, there remain bright spots, particularly in volume growth within specific segments. The challenge for BASF—and for similar companies in the broader chemical and industrial manufacturing sectors—is to manage a path through a market environment that is both intimidating and full of tricky parts.

From restructuring costs and special items to the revised economic forecasts, every detail merits careful attention. Investors and industry stakeholders alike would do well to take a closer look at the strategic adjustments BASF is making. In doing so, they not only gain insight into one of the world’s leading chemical companies but also catch a glimpse of the subtle dynamics that drive economic trends across sectors as diverse as automotive, electric vehicles, and industrial manufacturing.

Ultimately, while the current environment is laden with challenges—from unfavorable currency movements to the nerve-racking pressures of restructuring—there is also an underlying resilience built into BASF’s strategic planning. By focusing on operational efficiency, rebalancing product portfolios, and strengthening cash flow management, BASF is positioning itself to not just weather the storm but, in the long run, emerge stronger and more agile in a changing global marketplace.

For businesses and market participants, these developments underscore the need for constant vigilance and a willingness to adapt. As the global economy continues to evolve—with GDP growth, industrial production, and energy prices all shifting in subtle but significant ways—it is more important than ever to figure a path through the confusing bits and tangled issues that define today’s financial landscape.

The BASF case reminds us that while the road may be filled with twists and turns, strategic foresight and disciplined management can pave the way to a resilient future. Companies that heed these lessons will likely find themselves better positioned to take on the challenges ahead, fostering sustainable growth in an ever-changing world.

Key Takeaways and Recommendations for Industry Stakeholders

In summary, here are the main points to remember from BASF’s recent performance and the outlook for 2025:

- Sales have declined slightly due to negative currency effects and price pressures, but volume growth in key segments indicates underlying demand.

- Restructuring costs and special items are impacting short-term profitability, highlighting the need for careful management of operational expenses.

- Revised economic forecasts signal a slower global growth, necessitating a recalibration of strategic plans and risk management approaches.

- Despite the challenges, opportunities in technological advancements, sustainability efforts, and niche market expansions offer promising avenues for future growth.

- Maintaining strong cash flow and making prudent investments in efficiency are essential for both BASF and its industry peers in navigating the upcoming market twists.

As BASF and other leaders in the chemical market work their way through this tense environment, the lessons learned at this juncture will undoubtedly resonate across multiple sectors. Stakeholders are encouraged to digest these insights and adapt strategies accordingly, ensuring that every decision is informed by a detailed, data-driven understanding of the market’s fine points.

Concluding Reflections on BASF’s Path Forward

In closing, BASF’s Q2 2025 report clearly illustrates the balancing act companies must perform in a period marked by both positive growth in certain segments and significant margin pressures in others. With diverse external influences like unfavorable exchange rates, restructuring costs, and slower-than-expected macroeconomic growth, every small twist in the data reflects a broader truth—economic landscapes are ever-shifting, and flexibility combined with strategic clarity is essential.

For the industry, there is much to learn from this report. It provides an opportunity to take a closer look at how even large, established companies face challenges that are both intimidating and interconnected. Adapting to these changes will require not only robust financial management but also innovative approaches to technology, sustainability, and market engagement.

Ultimately, by working through the tricky parts and managing the delicate fine details of cost control and revenue generation, BASF is striving to secure a path toward long-term success. This journey, while full of complications and loaded with external risks, offers a valuable lesson: in today’s unpredictable business environment, companies must continuously adapt, innovate, and be ready to figure a path through every twist and turn that may come their way.

As we continue to observe BASF’s progress and the shifting dynamics of the global chemical market, one thing remains clear: staying informed and agile in response to these subtle economic signals is not just important—it is absolutely critical for success. With the right balance of caution and innovation, companies can not only survive but thrive in these challenging times, setting a strong example for others in the industrial manufacturing and broader business community.

Originally Post From https://www.inkworldmagazine.com/breaking-news/basf-group-reports-2q-2025-preliminary-figures/

Read more about this topic at

BASF Group releases preliminary figures for second …

Reporting